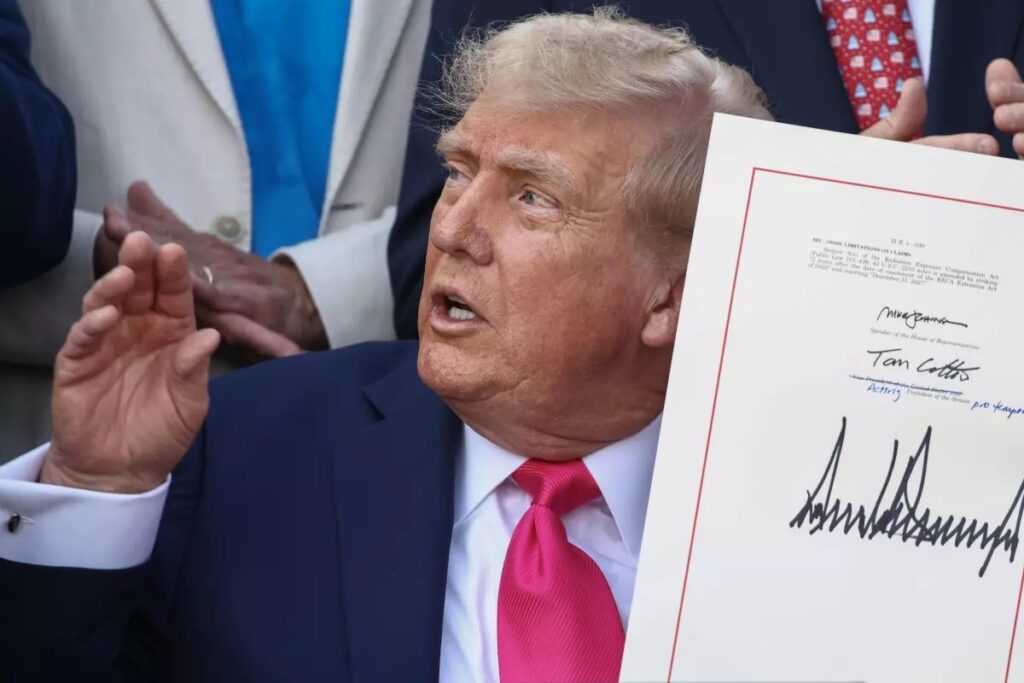

The One Big Beautiful Bill Act, Donald Trump’s signature second-term domestic legislative package, has finally been signed into law. The signing ceremony took place on Independence Day as fighter jets whooshed by and a stealth bomber streaked through the air during the White House’s annual fourth of July picnic.

The House approved the bill in a 218 to 214 vote, after the Senate narrowly approved the bill two days earlier in a 51-50 vote that required Vice President JD Vance to break a tie.

President Trump signed into law his nearly 900-page “Big Beautiful Bill” of tax breaks and spending cuts, affecting millions of Medicaid recipients while growing the Immigration and Customs Enforcement agency by thousands of workers.

The bill extends the 2017 Tax Cuts and Jobs Act, making most tax cuts permanent and increasing funding toward border security, defense and energy production. Extensive cuts to healthcare and nutrition programs such as Medicaid and the Supplemental Nutrition Assistance Program (SNAP) will partially pay for the bill.

The legislation allocates over $46.5 billion to border wall construction and related expenses, $45 billion to expand detention centers for immigrants in custody and about $30 billion for hiring, training and other expenses for the U.S. Immigration and Customs Enforcement.

It is estimated by the Congressional Budget Office that the new legislation would leave 11.8 million Americans without coverage under Medicaid, and increase federal debt by $3.4 trillion within the next ten years. The White House refutes these predictions.

The legislation includes restrictions on Medicaid, which provides government-sponsored health care for low-income and disabled Americans. The bill imposes work requirements for some able-bodied adults and more frequent eligibility checks. The Congressional Budget Office estimates that the bill would result in 11.8 million Americans losing health coverage under Medicaid over the next decade.

The Senate parliamentarian determined that a measure cutting federal funds to states that use Medicaid infrastructure to provide health care coverage to undocumented immigrants, along with banning Medicaid from covering gender transition services, wasn’t in compliance with Senate reconciliation rules. The parliamentarian also weighed in on what’s known as the provider tax, which states use to help fund their portion of Medicaid costs, in a blow to the Senate GOP’s initial plan.

The legislation includes more than $46.5 billion for border wall construction and related expenses, $45 billion to expand detention capacity for immigrants in custody and about $30 billion in funding for hiring, training and other resources for U.S. Immigration and Customs Enforcement.

It also includes a minimum $100 fee for those seeking asylum, down from the $1,000 fee outlined in the initial House bill. The Senate parliamentarian ruled out the $1,000 fee for anyone applying for asylum.

The package also includes an increase to the cap on the state and local tax deduction, raising it from $10,000 to $40,000. After five years, it would return to $10,000, a departure from the initial House-passed bill.

The issue was a major sticking point in the House, where blue-state Republicans threatened to withhold their support without the increase to the deduction. But with no Republicans hailing from blue states in the Senate, the upper chamber has been contending with its own dynamics.

Before the rule, taxpayers could deduct all their state and local taxes from their federal taxes, which some policymakers have said mainly benefits wealthy homeowners in states with high taxes, such as New York and California. But advocates for increasing the caps argue that the $10,000 cap is increasingly impacting middle-class homeowners who live in regions where property taxes are rising.

The bill still shifts the costs of SNAP, or food stamps, to some states. The program is currently fully funded by the federal government.

The federal government would continue to fully fund the benefits for states that have an error payment rate below 6%, beginning in 2028. States with error rates above 6% would be on the hook for 5% to 15% of the costs. States are also given some flexibility in calculating their share.

The package also aligns with the initial House version on age requirements for able-bodied adults to qualify for SNAP benefits. Currently, in order to qualify, able-bodied adults between 18 and 54 must meet work requirements. Both the Senate and House bills would update the age requirement to 18 and 64, with some exemptions for parents.

Alaska and Hawaii could receive waivers for the work requirements if it’s determined that they’re making a “good faith effort” to comply.

The legislation would raise the debt ceiling by $5 trillion, going beyond the $4 trillion outlined in the initial House-passed bill. Congress faces a deadline to address the debt limit later this summer.

Treasury Secretary Scott Bessent has urged Congress to address the debt limit by mid-July, saying that the U.S. could be unable to pay its bills as early as August, when Congress is on recess.

By addressing the debt ceiling as part of the larger package, Republicans in Congress aimed to bypass negotiating with Democrats on the issue. Unlike most other legislation in the Senate, the budget reconciliation process that governs the package requires a simple majority, rather than the 60-vote threshold to move forward with a bill.

America was on track to add a lot more energy to the grid through the rapid growth of the clean energy industry. However, the BBB rolls back clean energy tax credits that energy developers were relying on to make that growth happen. Without these incentives, many clean energy projects will get cancelled and leave the U.S. with less energy than it needs in a time of rising energy demand. The Trump administration and Congress are attempting to offset this reduction of electricity supply with more fossil fuel development. However, relying more on fossil fuels for electricity will only end up raising consumer costs due to their higher operating and maintenance costs compared with clean energy.

By reducing the generation of the affordable clean energy added to the grid, the bill will leave Americans with higher energy bills. The BBB would increase average annual electricity costs by $110 per household as early as next year, with some states seeing more than $200 increases annually.

The Big Beautiful Bill Act increasing costs and hurting U.S. businesses and jobs is bad enough and at this point the Trump administration seems to be tone deaf to the mood and body language of Americans.

There is absolutely no doubt that the Congressional Republicans’ bill will have ugly consequences that will take years to reverse. Some of these harms will be irreversible and will haunt Americans for years to come.